7 Months ago we did an SREC 101 Episode for HeatSpring TV. The goal of the first interview was simple: to provide basic information on what SRECs are, the state of the current market, and what installers should know about SRECs to sell projects to their clients.

We’ve decided to provide a regular update with SRECTrade on the status and the development of the SREC markets. We’ll discuss policy updates, events that are impacting the supply and demand of existing markets, and expectations for upcoming markets. For example, last week Maryland changed their RPS requirements.

SRECs are extremely important in specific markets because they impact a contractor’s or developer’s ability to sell projects. However, they are changing rapidly and sometimes it’s difficult to get clear answers.

For this update, I spoke with Steven Eisenberg who is the VP of Business Development with SRECTrade. He manages the relationships between all the buyers of SRECs and the sellers of projects that are larger then 250kW. Because he is at the intersection of clients that are buying and those that are selling SRECs, he has great insights into the dynamics of the SREC market.

(Please note: The interview was filmed on Friday, March 30th and some SREC policies have changed since filming)

Here is the full agenda of what we talked about:

Question: What is happening in each market regarding legislation that will impact SREC prices, supply and demand, in the next couple months?

- NJ: Coming from 2011 and prior periods there was an under-supply leading to high prices and this lead to a huge build up and now the market is oversupplied. The market has hit a point that through February 2012, 689MW of capacity can is eligible for SRECS .40MW was installed in February 2012.

- There is huge oversupply. NJ state only needs 370MW operational throughout the 2012 compliance year to supply the needed SRECs required by the RPS. The requirement for 2013 and 2014 is LESS THAN what has been installed through February 2012.

- There have been a variety of different policy groups looking to increase the RPS requirements to take up some of that supply, but it is uncertain this will happen in the near term.

- In our March NJ spot auction, SRECs were traded at $145 per MWh and traded at $135 per MWh in the April auciton. Other transactions have since traded below the $135 level.

- Without any legislative change, NJ will be oversupplied for the next few compliance periods.

Question: In some ways, is this news good for the NJ industry? It will drive out unprofitable solar EPC companies?

- Answer: Surely the most competitive financiers, developers, EPC contractors, and customers with high energy costs will be in the best position.

- The decline in equipment cost is also really helping.

- Projects now need to be really competitive to pencil out.

Question: What have you noticed tends to be the characteristics of the BEST projects that are still working out?

- Answer: Projects that are easily interconnected tend to really help

- A healthy PPA rate and low installed costs always help

- Also, if the project incorporates a corporate entity that has a strong balance sheet with a good banking relationship it will make the financing cheaper and more accessible.

Questions: Is there any talk in NJ of putting a floor on the market like in Mass? Also, do you think the same thing is going to happen in MA, a huge supply increase due to high SREC prices and how cheap it is to set up sales offices?

- Answer: There was some legislation being considered in NJ around a floor price. It didn’t make it that far in the legislative process and thus a lot of the focus was on increasing the RPS to handle over-supply.

- Regarding Mass potentially seeing an over-supply, it’s surely possible given the fact that Pennsylvania and NJ are oversupplied so a lot of companies are moving north.

- The issue around Mass is that we haven’t seen a clearinghouse yet. The market is still under-supplied in 2011. It looks like the market is very attractive which is fueling growth and the market can still also be volatile because it’s so small and in some instances may be easy to meet the requirements in the earlier stages as the market sees increases in growth and larger projects coming online.

- We performed a Mass analysis for the 2012 period. At the end of 2011, there was 48MW installed capacity. We did some analysis for different scenarios given historic build rates and what happens to the market if it stays constant, decreases or increases.

- Over the past 12 periods, on average, 4MW were installed per month. If you keep this build rate constant the market will eventually become slightly over-supplied.

- There are a few issues in Mass, especially around interconnection. Projects over 1MW are taking longer to receive interconnection approval then expected, which is could impact SREC supply.

- However, there has been a fair amount of development interest in the middle scale built environment. You don’t need many hundred kW systems to hit the 4MW/month target. This was also a very popular category in NJ throughout the 2011 and current compliance periods.

Question: How easily can you predict the projects that are coming online? What is your ability to predict the installed capacity that is going to be commissioned?

- A: You can track multi-MW projects through an interconnection project list available on the DOERs site. But it’s hard to tell exactly where the projects are at in the development cycle.

- The lack of liquidity in the forward contract MA market may also have an impact on development.

Question: What are you seeing happening in the rest of the markets around the mid-atlantic?

- PA is substantially over-supplied. House Bill 1580 is still going through the house. It’s goal is to increase the RPS requirement for 2013 – 2015 and then continue with the existing requirements.

- Projects are still getting put online in PA.Recent SREC prices, depending on vintage, have ranged from $10 to$30/MWh.

- In Washington DC, in the fall of 2011 the DG amendment act was passed, which requires all systems installed to be sited in the District to be eligible for SRECs moving forward.

- As a result, the price in DC is increasing. Geographically, and due to the nature of the market in DC, a lot of the projects will be smaller in size.

- In addition to PV, solar thermal system can also apply for SRECs in DC.

Question: What are the reporting requirements for SHW systems in DC? Is it based on actual production or estimate production?

- Type of meter that is needed depends on the capacity size of the solar thermal system.

- Maryland allows for solar thermal systems to apply for SRECs

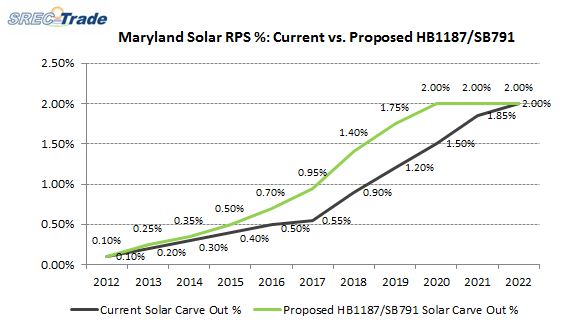

- In Maryland, there is also legislation to pull forward the RPS requirements.

- There are a few large projects coming online in MD; 20MW and 17.4MW.

- These large projects will have a substantial impact on the market due to the current SREC requirements.

Question: Lastly, what is your outlook on other states creating SREC programs? Other then Illinois, do you see other states looking to increase programs?

- Yes. Right now, we see that CT is the state most likely to come online soon. It will be implemented through an RFP through the regulated utilities, Connecticut Power and Light and United Illuminating.

- In the first solicitation, $8 million will be set aside for 15 year REC contracts for projects that are less than 1 MW in size.

- Currently, structured under 3 size tiers: 1) 0-100kW, 2) 100kW-250kW, 3) 250kW – 1 MW. Depending on REC pricing, it is estimated the first solicitation will accept 30-40 MW of capacity.